How does the tax rebate work?

How does the tax rebate work?

RETNS is a registered charity (RCN 20118587) and is eligible for Revenue’s Charitable Donation Scheme (https://www.revenue.ie/en/companies-and-charities/charities-and-sports-bodies/charitable-donation-scheme/index.aspx), which allows tax relief on qualifying donations.

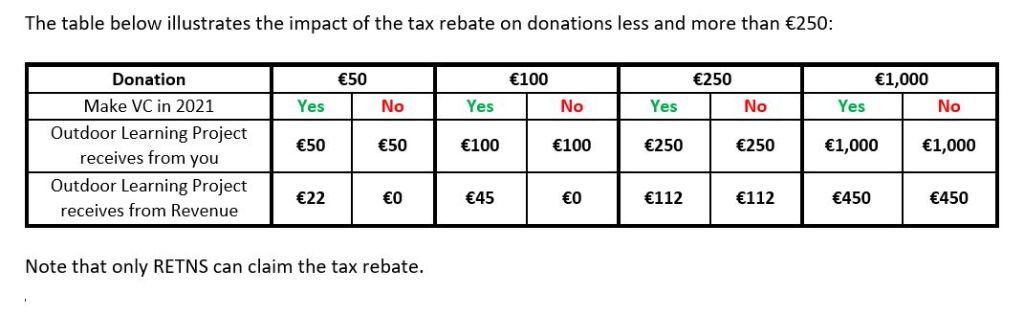

A qualifying donation is an amount of €250 or more in a calendar year received from an individual who pays income tax (whether self-assessed or PAYE-only taxpayers).

The sum of any donations (including any voluntary contributions) received during the 2021 calendar year will be calculated in January 2022. If the total amount received in 2021 from an individual is €250 or more then the total amount qualifies for a tax rebate.

If you make the suggested voluntary contribution each year, as most of the families in our school do, any donation that you make towards this project will qualify for the tax rebate since your annual contribution will already exceed €250.